Project Description#

The main goal of this project is to identify and predict the loan status of lenders.

To figure out whether the dataset has time series characteristic, two cross-validation methods (K-fold, TimeSplit) are also used.

In this project, RandomForest is the main model to predict and analyze the loan status.

(The Dataset for model training includes 916567 rows and 10 columns from 2007 to 2017.)

Data can be found in my

GitHub Repository

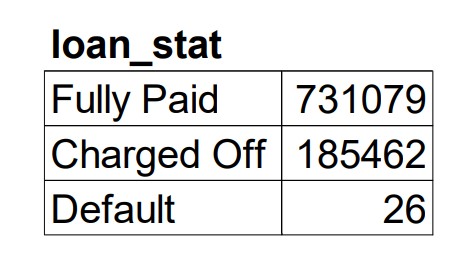

Response Variable#

- Loan_Stat -> Including 3 status, Fully Paid, Charged Off, and Default

Explanatory Variables#

Annual_Inc -> Annual incomeEmp_Length -> Employment lengthDti -> The debt-to-income ratio of the borrowerDelinq_2yrs -> The number of times the borrower had been 30+ days past due on a payment in the past 2 yearsTerm -> Borrowing termGrade -> History credit gradingInq_Last_6mths -> The borrower’s number of inquiries by creditors in the last 6 monthsPurpose -> Purpose for borrowing

Feature Engineering#

loan_stat#

- Fully_Paid -> 0

- Defult, Charged-Off` -> 1

Grade#

- A, B, C, D, E, F, D -> 1, 2, 3, 4, 5, 6, 7

Purpose#

- Debt_Consolidation -> 1

- Other -> 0

1

2

3

4

5

6

7

8

|

#getting dummies for loan_status

data_df['loan_status'] = data_df['loan_status'].str.replace('Charged Off', '1')

data_df['loan_status'] = data_df['loan_status'].str.replace('Default', '1')

data_df['loan_status'] = data_df['loan_status'].str.replace('Fully Paid', '0')

#getting dummies for purpose

data_df.loc[data_df['purpose'] != 'debt_consolidation', 'purpose'] = 0

data_df.loc[data_df['purpose'] == 'debt_consolidation', 'purpose'] = 1

|

Data Resample#

This is a very imbalance, the following plot shows that the ratio of positive data is around 20%.

I implemented the SMOTE, which is the over-sample method to increase the number of positive data.

1

2

|

# SMOTE implementation

X_re, y_re = SMOTE(random_state=1111).fit_resample(X_train, y_train)

|

Random Forest Modeling#

Random Forest Classifier is the main model used in this project.

The following code example shows the parameters used in the RF model.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

|

def clf_original():

#split train, test dataset

X_train, X_test, y_train, y_test =\

train_test_split(X, y, test_size=0.25, shuffle = False)

#data resample, using SMOTE

X_re, y_re = SMOTE(random_state=1111).fit_resample(X_train, y_train)

clf = RandomForestClassifier(n_estimators=100, max_depth=18, random_state=1111, criterion='entropy')

clf.fit(X_re, y_re)

train_predictions = clf.predict(X_re)

test_predictions = clf.predict(X_test)

cm = confusion_matrix(y_test, test_predictions)

print(accuracy_score(y_re, train_predictions))

print(accuracy_score(y_test, test_predictions))

print(precision_score(y_test, test_predictions))

print(cm)

sorted_idx = clf.feature_importances_.argsort()

plt.barh(X.columns[sorted_idx], clf.feature_importances_[sorted_idx])

plot_confusion_matrix(clf, X_test, y_test)

plt.show()

|

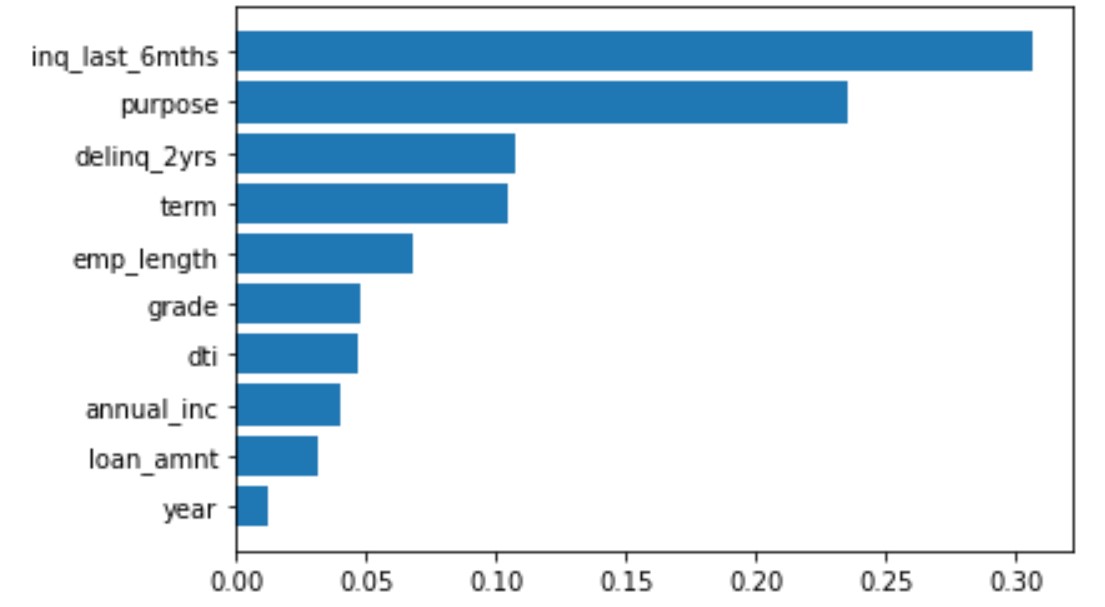

[Feature importance]

[Feature importance]

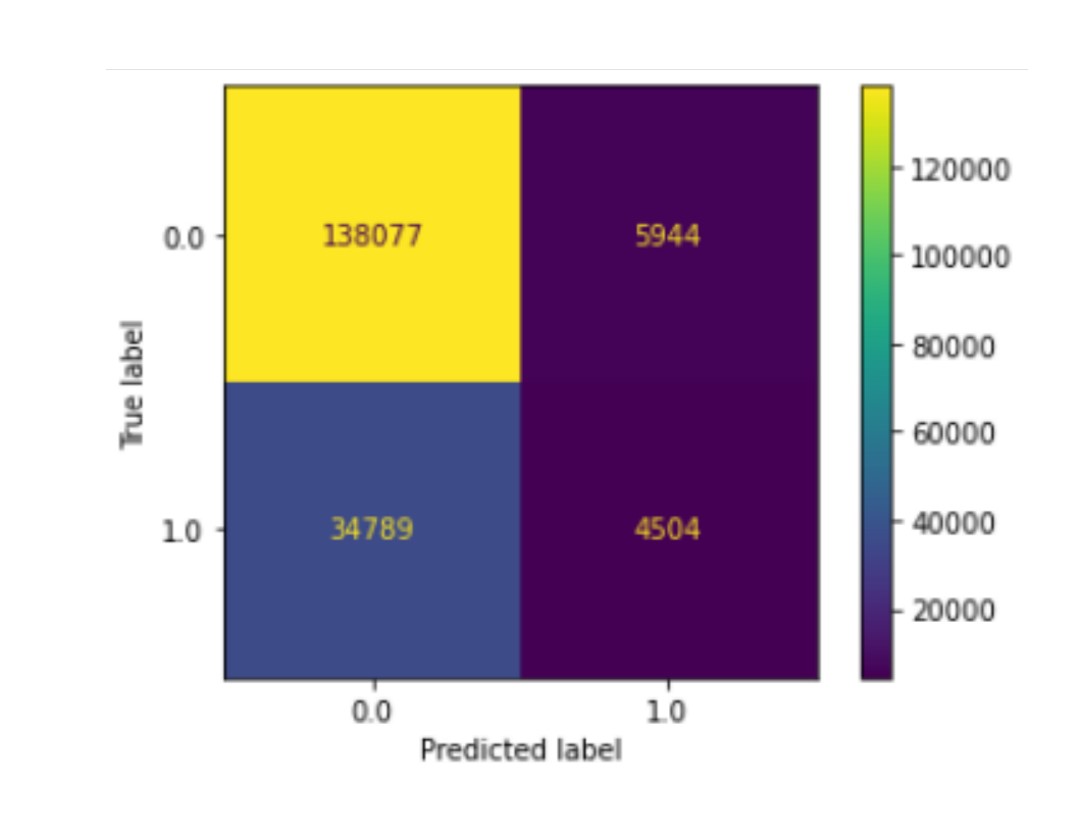

[Confusion Matrix]

[Confusion Matrix]

Cross-Validation#

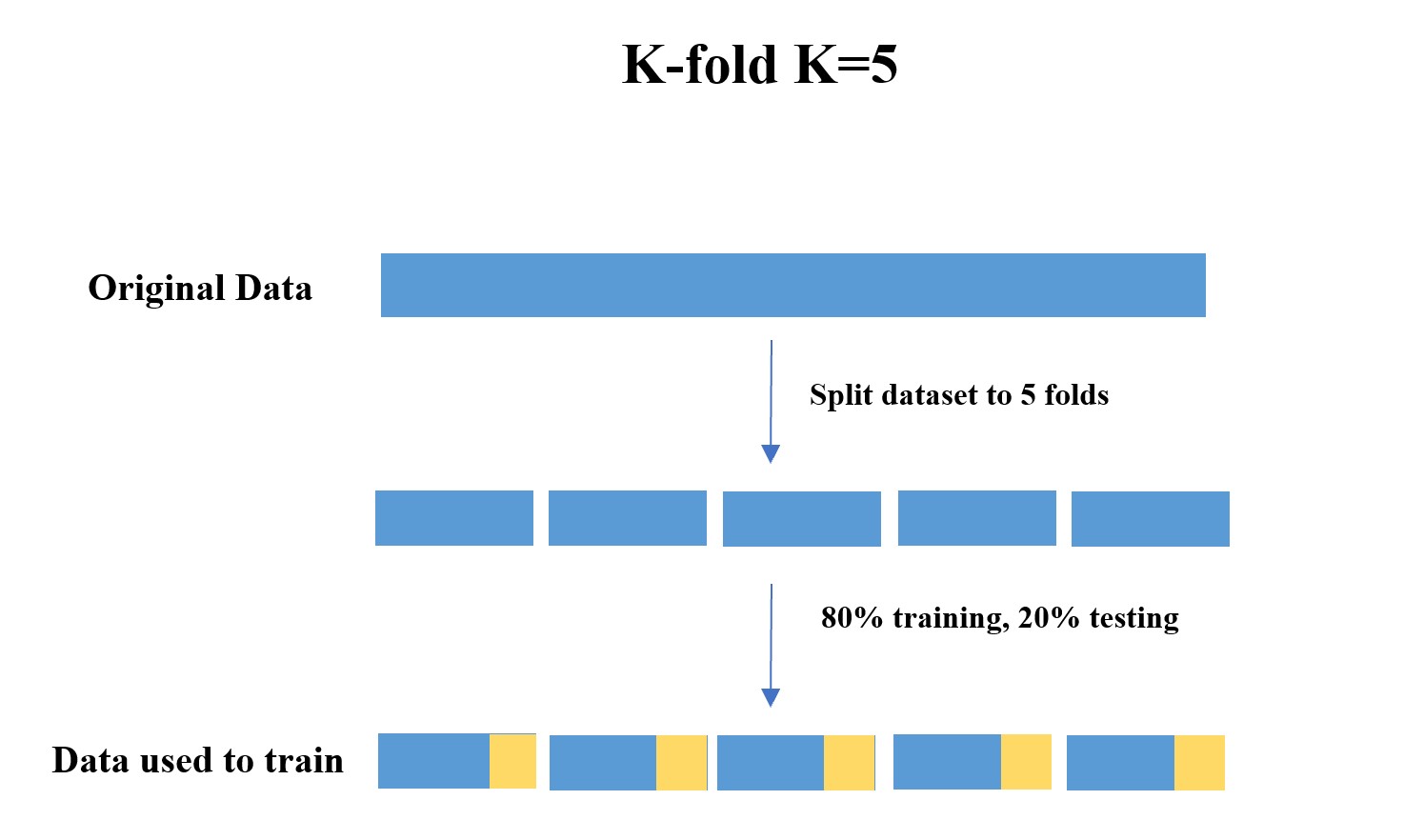

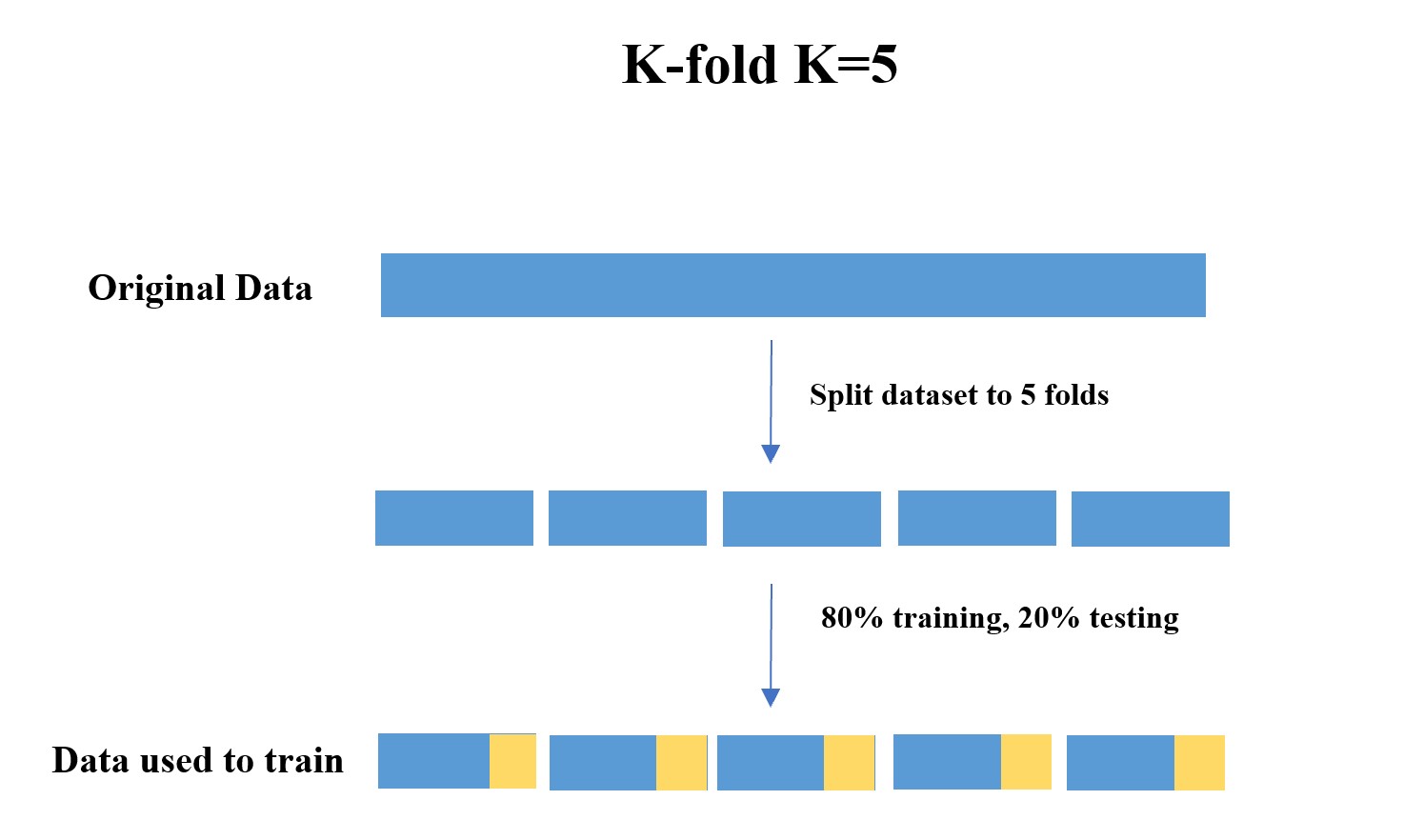

In model cross validation, I used both K-fold (K=5) and Time-Series methods to validate the RF model.

K-fold#

The dataset was first shuffle randomly then split into 5 folds.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

|

def shuffle_kfold():

#shuffle dataset and run K-fold

in_dic = {0:[0,146649],1:[146650,183313],2:[183314,329964],3:[329965,366628],4:[366629,513279],5:[513280,5499943],6:[549944,696594],7:[696595,733258],8:[733259,879908],9:[879909,916565]}

avg_precison = []

avg_recall = []

avg_accuracy = []

train_index = 0

test_index = 1

data_df_1 = data_df.sample(frac=1)

data_df_1 = data_df_1.reset_index(drop=True)

y_1 = data_df['loan_status']

X_1 = data_df.loc[:, (data_df.columns!='loan_status') & (data_df.columns!='recoveries') & (data_df.columns!='total_rec_prncp') & (data_df.columns!='total_pymnt')]

for i in range(5):

train = in_dic[train_index]

test = in_dic[test_index]

X_train = X_1[train[0]:train[1]]

X_test = X_1[test[0]:test[1]]

y_train = y_1[train[0]:train[1]]

y_test = y_1[test[0]:test[1]]

X_re, y_re = SMOTE(random_state=1111).fit_resample(X_train, y_train)

clf = RandomForestClassifier(n_estimators=100, max_depth=18, random_state=1111, criterion='entropy')

clf.fit(X_re, y_re)

train_predictions = clf.predict(X_re)

test_predictions = clf.predict(X_test)

train_accuracy = round(accuracy_score(y_re, train_predictions), 3)

test_accuracy = round(accuracy_score(y_test, test_predictions), 3)

avg_accuracy.append(test_accuracy )

print(train_accuracy)

print(test_accuracy)

avg_precison.append(round(precision_score(y_test, test_predictions), 3))

avg_recall.append(round(recall_score(y_test, test_predictions), 3))

plot_confusion_matrix(clf, X_test, y_test)

plt.show()

train_index += 2

test_index += 2

avg_precision_score = sum(avg_precison) / len(avg_precison)

avg_recall_score = sum(avg_recall) / len(avg_recall)

print(avg_precision_score, avg_recall_score)

return(avg_precison, avg_recall, avg_accuracy)

|

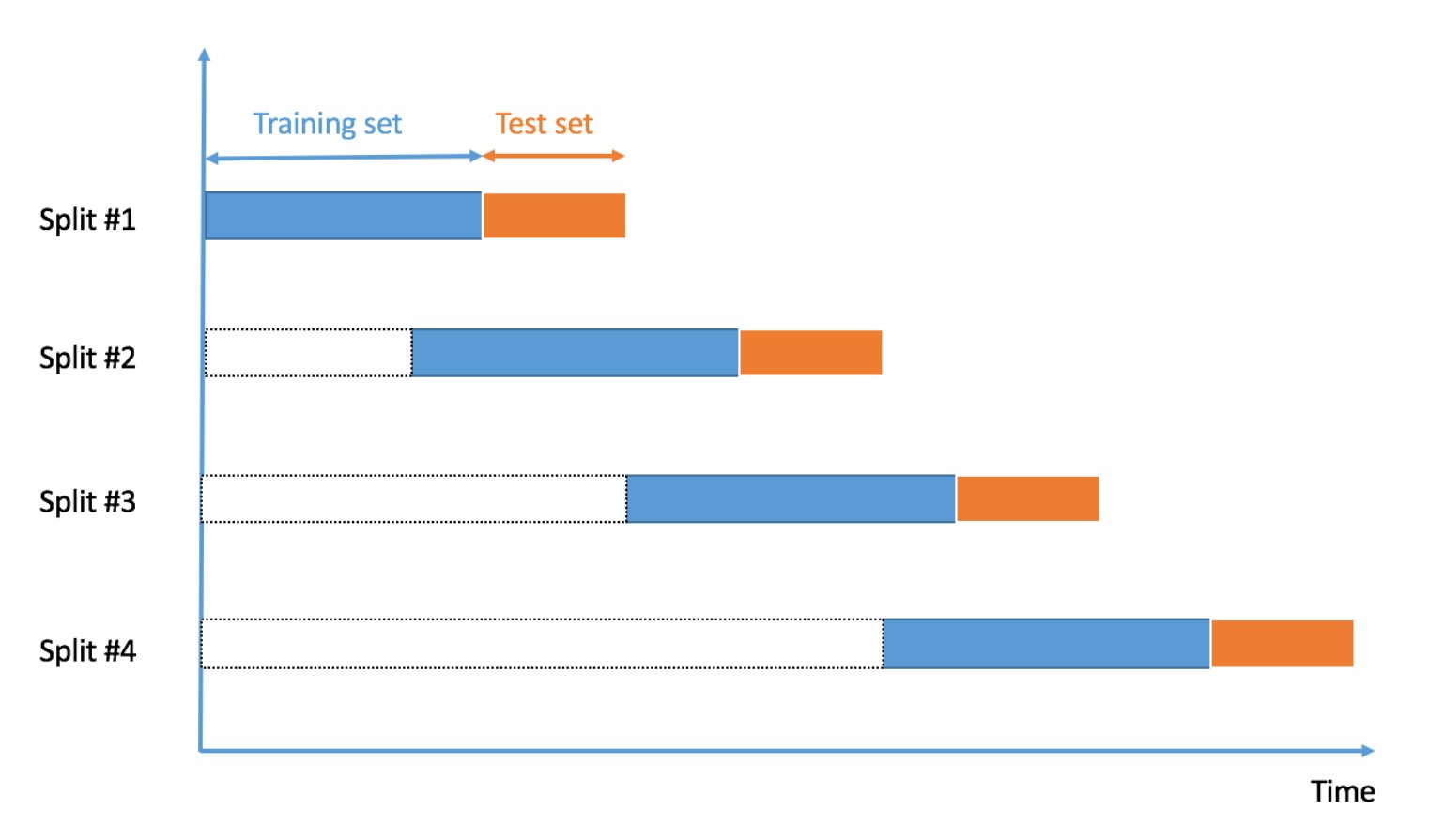

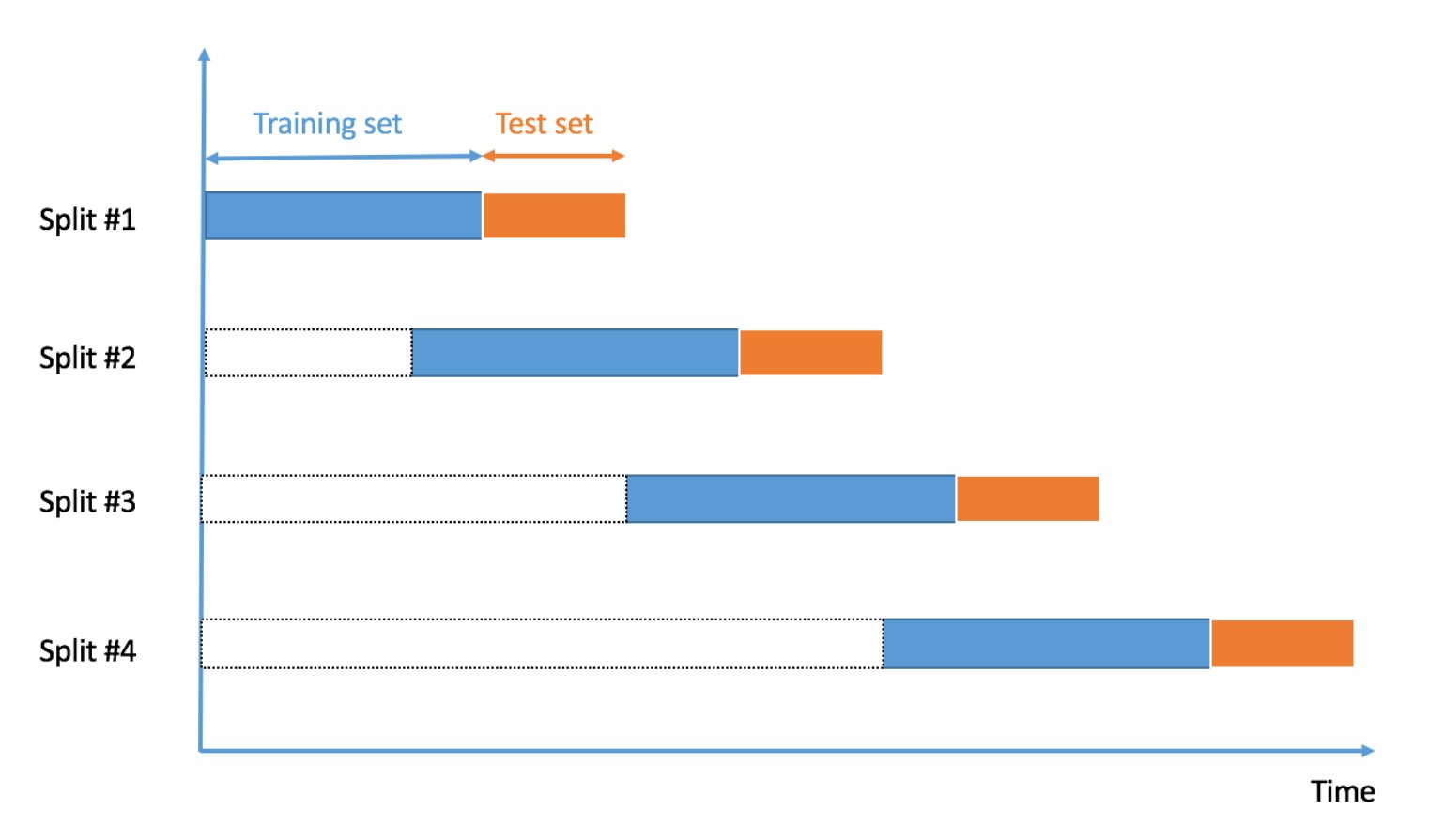

Time-Series#

The dataset was split based on the year.

Split1: 2013-2014

Split2: 2014-2015

Split3: 2015-2016

Split4: 2016-2017

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

|

def time_split():

avg_precison = []

avg_recall = []

avg_accuracy = []

years_list_1 = [2013, 2014, 2015, 2016, 2017]

for year in years_list_1:

#filter year for train data

train_data = data_df[data_df['year'] == year]

#subset X, y dataset

X_train = train_data.loc[:, (data_df.columns!='loan_status') & (data_df.columns!='recoveries') & (data_df.columns!='total_rec_prncp') & (data_df.columns!='total_pymnt') & (data_df.columns!='year')]

y_train = train_data['loan_status']

#count total row for training data

row_count = y_train.count()

#set test data size: round to interger

test_count = int(row_count*0.2)

X_re, y_re = SMOTE(random_state=1111).fit_resample(X_train, y_train)

#filter year for test data

if year<2017:

test_data = data_df[data_df['year'] == year+1]

#subset X, y dataset

X_test = test_data.loc[:, (data_df.columns!='loan_status') & (data_df.columns!='recoveries') & (data_df.columns!='total_rec_prncp') & (data_df.columns!='total_pymnt') & (data_df.columns!='year')][0:test_count]

y_test = test_data['loan_status'][0:test_count]

else:

break

clf = RandomForestClassifier(n_estimators=100, max_depth=18, random_state=1111, criterion='entropy')

clf.fit(X_re, y_re)

train_predictions = clf.predict(X_re)

test_predictions = clf.predict(X_test)

train_accuracy = round(accuracy_score(y_re, train_predictions), 3)

test_accuracy = round(accuracy_score(y_test, test_predictions), 3)

avg_accuracy.append(test_accuracy )

print(train_accuracy)

print(test_accuracy)

avg_precison.append(round(precision_score(y_test, test_predictions), 3))

avg_recall.append(round(recall_score(y_test, test_predictions), 3))

plot_confusion_matrix(clf, X_test, y_test)

plt.show()

avg_precision_score = sum(avg_precison) / len(avg_precison)

avg_recall_score = sum(avg_recall) / len(avg_recall)

print(avg_precision_score, avg_recall_score)

return(avg_precison, avg_recall, avg_accuracy)

|

Result and Conclusion#

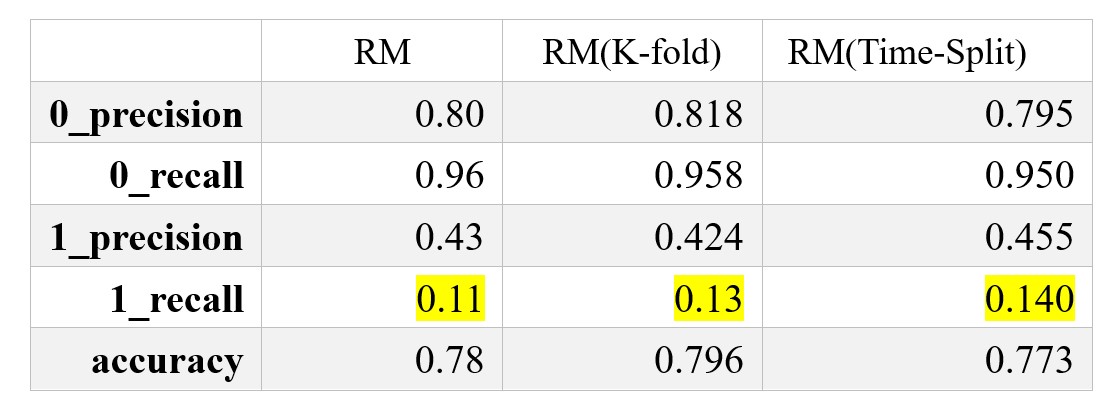

In this project, the biggest challenge is to deal with the imbalance data and come up with more creative feature engineering method.

After the SMOTE was implemented, the model gains a big improvement on the prediction power on the positive data.

However, the recall rate is still low.

To improve the model performance further,hyperparameter tuning might be a good method. Since we already create the cross-validation Pipeline, the hyperparameter tuning should be easy to be added.

GitHub Repository

This is a academic project supervised by Kao, Ming-Sung from Fu Jen Catholic University. I’m very grateful to him for his enthusiastic and responsible supervision on the project.

[Feature importance]

[Feature importance] [Confusion Matrix]

[Confusion Matrix]